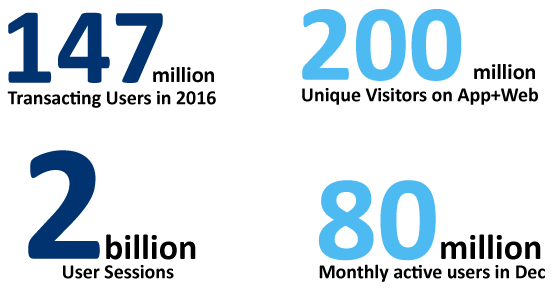

Fintech Industry is witnessing the next big disruption with digital payments apps making their way in every business vertical. Over $2billion funds have been raised by 90 companies in Fintech sector out of which 1.4 billion funds are only for Paytm.

Ranked as India’s largest digital company, Paytm’s revenue grew to INR 813.88 crore for the fiscal year 2016-17. As a result of demonetization in India, people moved to cashless economy which lead to 7 million transactions in Paytm worth INR 120 crore in just 12 days.

Paytm has been successfully adopted by everyone, including the ones who have the least of tech knowledge like vegetable vendors. In a short span, Paytm has achieved phenomenal success. After getting Payments Bank License from RBI, Paytm became one of the first digital payment banks company. With time, it extended its model into m-tailing, seller services, payment wallet and what not.

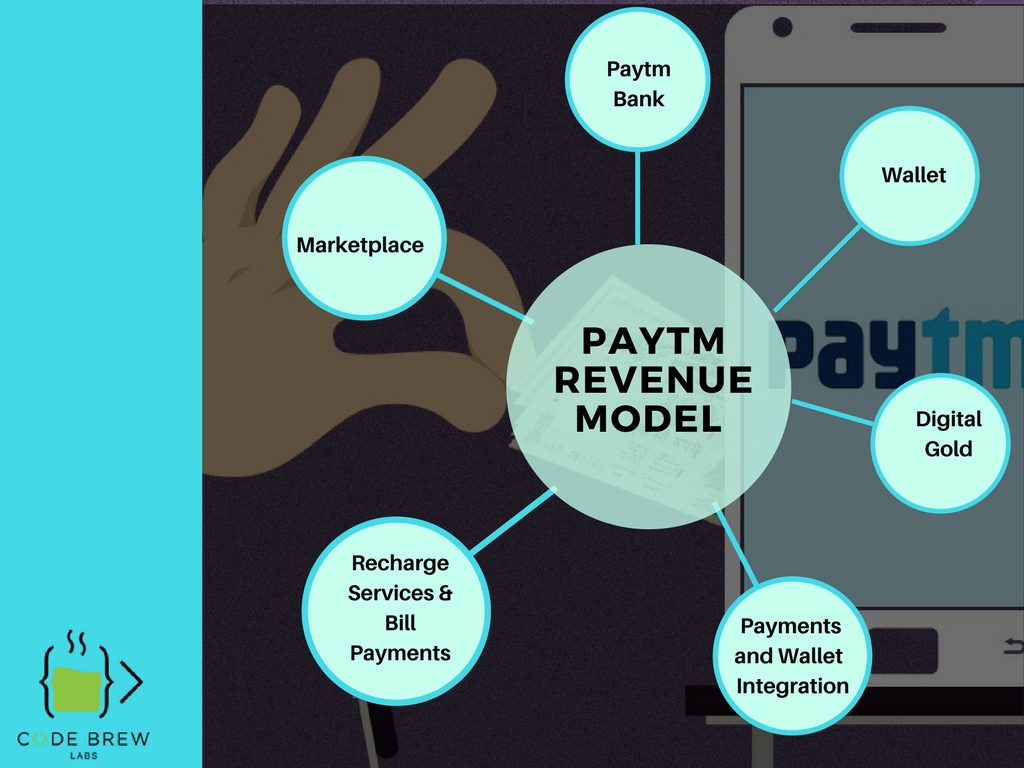

How does Paytm earn?

Majority of the people, especially customers wonder about Paytm’s revenue model. This is due to the fact that the giant digital bank gives huge amount of cashback every now and then. However, that cashback amount cannot be refunded in customer’s bank account. Let’s have a close look at Paytm’s revenue model.

Paytm Mall

Recharge Services and Bill Payments

Payments & Wallet Integration

Digital Gold

Paytm Bank

Paytm Mall

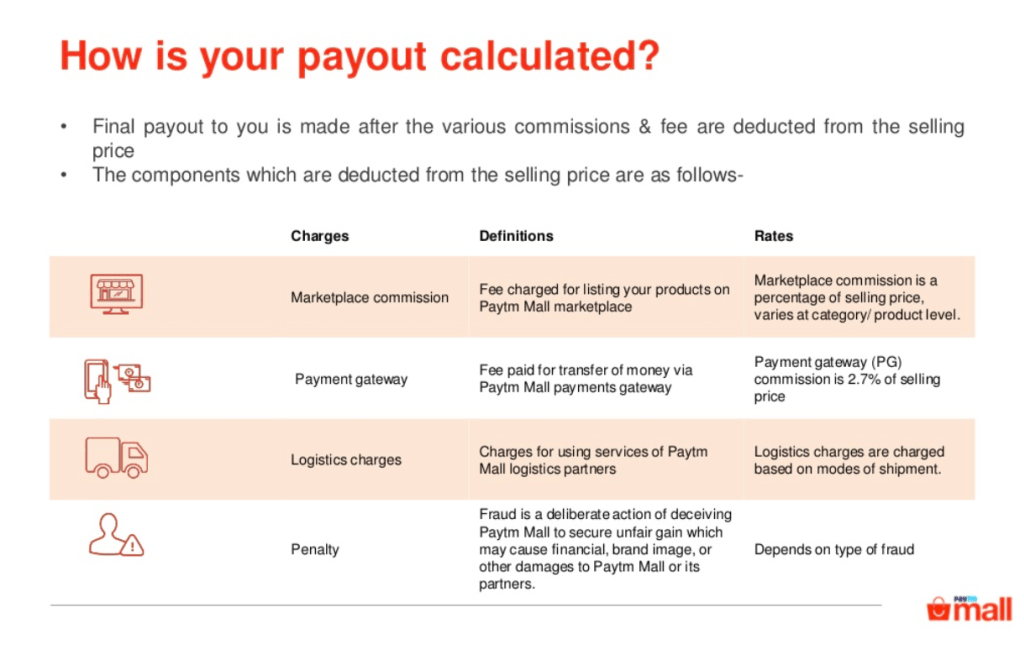

Paytm introduced India’s first mobile only marketplace, Paytm Mall that has more than 120 million buyers and around 2.5 million transactions are recorded on daily basis today. Sellers consider it to be the most beneficial marketplaces to sell their services or products. Revenue generation is on the basis of commission fees that is charged to sellers as per different products.

Recharge Services and Bill Payments

Paytm actually got popular because of its online recharge and bill payment services. Being among the first online recharge providers, Paytm covered all mobile operators, dish operators, data-card providers etc. Moreover, it enabled bill payments of TV subscriptions, mobile postpaid numbers, electricity, water etc.

Revenue came in from the commissions charged from all operators and service providers.

Payments & Wallet Integration

Paytm offer payment solutions for enterprises charging commission of 1.9% at every transaction. Using the payment solution, businesses can enable online payment for their customers through:

WhatsApp

Mobile App

Website

Complete SDKs are provided without any setup or maintenance charges. Developers can install the same and integrate Paytm payments in the web or mobile solution.

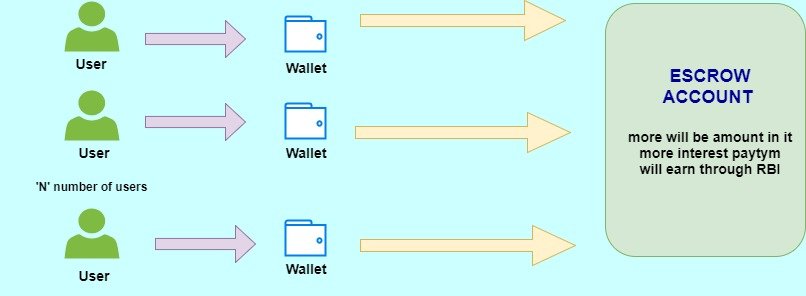

Payment earns a lot even after providing cashbacks on all its products and services. Paytm wallet is the answer to this. So, the cashback that customers get can only be availed through Paytm Wallet. So, you do not get any money back but you get some amount to purchase new

Stuff.

The cash in Paytm wallet is deposited in Escrow Account. The Escrow Account gets a certain interest amount for Paytm and this is how Paytm makes money through Paytm wallet.

The money deposited by users in Paytm wallet, as per RBI Guidelines, is deposited by Paytm in an Escrow Account with a certain bank. This escrow account deposit fetch Paytm certain interest which is decided as per the contract between the bank and Paytm.

Digital Gold

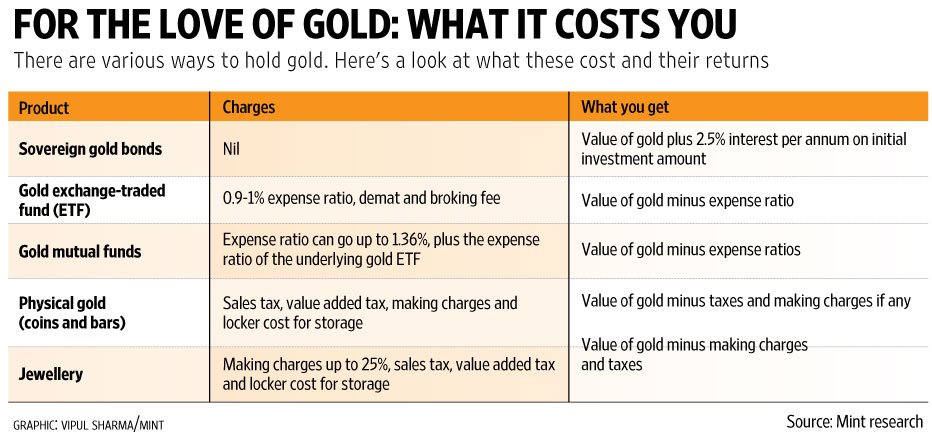

Considering gold to be one of the most preferred investment because of its monetary benefits over long time, Paytm planned to capitalize on the same.

Customers will be able to hold a gold bank account where they will buy and store the gold in digital form. This does not end here as Paytm plans to enable the customers use the invested gold to avail other services such as book movie tickets, purchase merchandise, pay bills etc. There will also be an online platform for jewellers where they will be able to connect with customers directly. Thus, Paytm will have its money from the jewellers by being their affiliate.

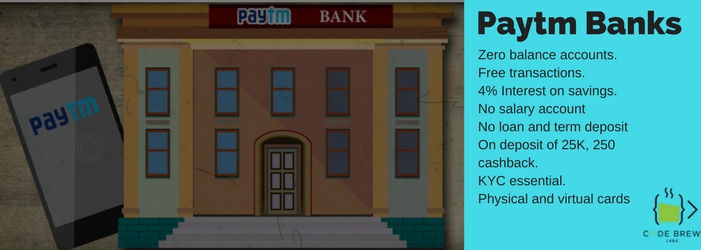

Paytm Bank

Paytm Wallet will grow into a complete payments bank. It will have debit cards for people who don’t use mobile application. The cards will have QR codes that will be scanned at various places to make payments.

Bottomline

Paytm has shown a phenomenal growth over a small duration. Demonetization proved to be the most beneficial to Paytm. However, the company did not stop there. It took a step forward with other cashless investment options. Companies that keep evolving with time are the ones that sustain and this fact is best known to Paytm.