Cryptocurrency is the latest buzz word. You might have heard someone or the other talking about investing in some kind of cryptocurrency. While Bitcoin was the first cryptocurrency that got popular across the globe, there is a huge list of different cryptocurrencies that you still have not heard of. That being said, have you ever wondered about when and where did the concept of cryptocurrency originate.

Back in 2016, you might have read papers on blockchain project without any clue about it. The basic concepts were left untouched which made it look more of an overnight issue. Digital cash brought a new term with it; cryptocurrency. In this blog, we will discuss everything about cryptocurrency considering all the basic things first and then coming to a conclusion about its future scope.

How Cryptocurrency originated?

If you look at the history of great inventions, you will realize that most of them were unplanned. Cryptocurrency was also invented unintentionally by Satoshi Nakamoto (unknown inventor) in the form of Bitcoin. His main aim was to develop a peer-to-peer electronic cash system as mentioned in one of his announcements in 2008. The e-cash system i.e. Bitcoin was released to prevent overspending with no server or central power. In an attempt to create digital cash system, many failed but Satoshi finally found a way to create decentralized electronic cash system.

Using the peer-to-peer network concept that we use for file sharing, Satoshi tried his hand on creating the electronic cash system without the use of central authority or entity. This very decision gave birth to cryptocurrency. Satoshi had found the missing piece that was required to realize digital cash.

Let us understand it in simple terms:

For digital cash realization, a payment network is required that should have valid accounts, balances and transaction records. The biggest problem that is common to every payment network is double spending. It means the entities have to make a payment of same amount twice. This is normally done through central server where all the balance records are kept.

When you take out the server, it becomes a decentralized server. So every entity on the network has to do the job of a server i.e. to maintain list of transactions and balance records. Thus, it is mandatory for all entities to keep a consensus about all these records.

In peer-to-peer network, every entity has to agree on every transaction or balance. In case, peers disagree about a single minor balance record, everything halts. This scenario is handled with a central authority that provides the correct state of all balances. However, in absence of a central server there was no way to do it until Satoshi found one.

He was able to achieve consensus without involving any central authority and cryptocurrencies were invented as the side-product of this process.

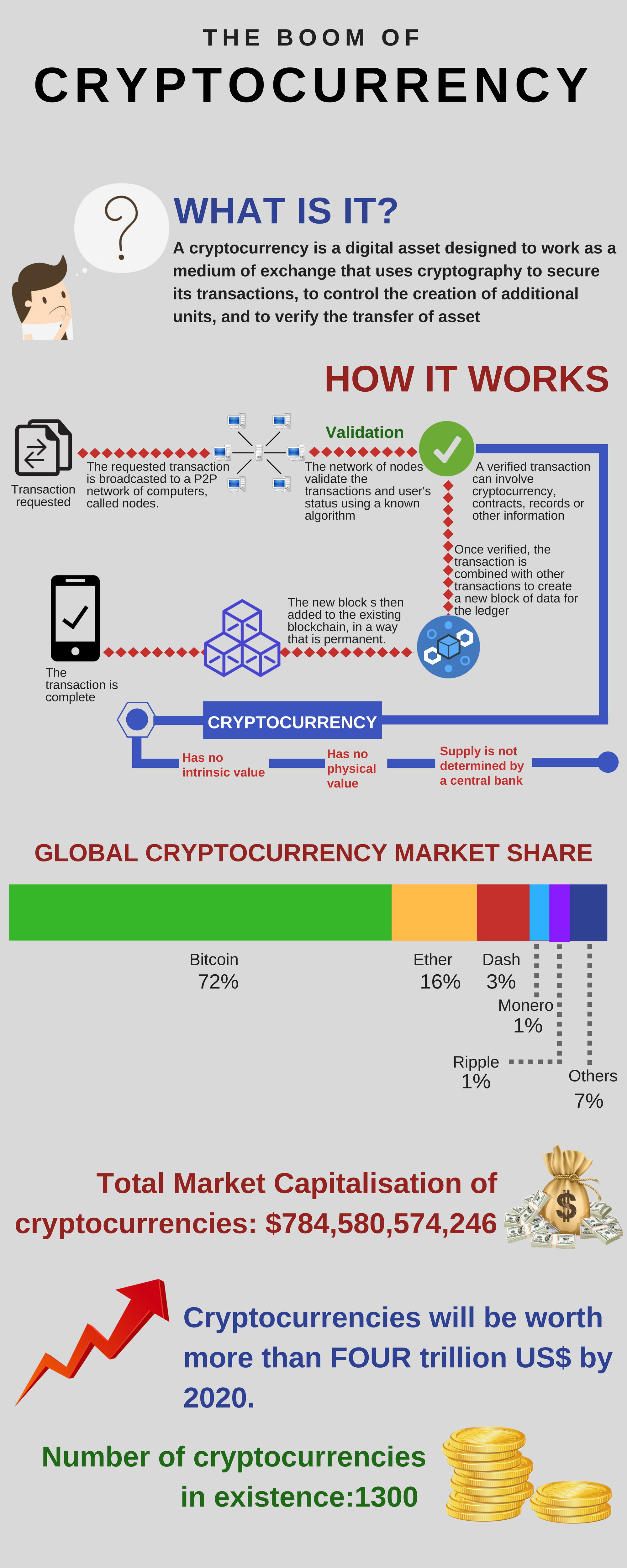

What are cryptocurrencies really?

First, it is no rocket science and here we will explain it in simple terms. Cryptocurrencies are some database entries that cannot be changed by anyone without accomplishing certain specific conditions. Yes, this is the most simple term that can be used to explain cryptocurrency.

Let us apply this very definition to your normal tangible currency that you use in your daily life. The money in your bank account displays entries from the bank’s database. The entries change only under certain conditions. The money in your account does not increase or decrease randomly. Money is all about verified entries resting somewhere in databases of accounts, transactions and balances.

How miners create coins and confirm transactions

As mentioned earlier, cryptocurrency has a network of peers. With each peer, there is a complete history of transaction records which includes balance of every account.

A transaction is some file that is signed with a private key. Like any other p-2-p network, this file is sent from one peer to another peer.

The whole network knows about the transaction after a certain time of confirmation.

Confirmation is critical in any cryptocurrency. Until and unless a transaction is unconfirmed, it remains pending and can be forged. On the other hand, a confirmed transaction is not forgeable. It becomes the part of the blockchain (historical transactions record). In a cryptocurrency network, miners hold the right to confirm transactions. They take/receive transactions and stamp them as legit before spreading across the network. Every confirmed transaction is then added to every peer’s database. Miners in return get token of cryptocurrency such as Bitcoins.

The Revolution Of Cryptocurrency

Cryptocurrencies are the mere entries of token stored in the decentralized databases that keep consensus of all balance and account records. The word CRYPTOcurrency is used because cryptography process is used to keep the consensus records safe and secure. These currencies are secured by math and logic rather than trust and people.

Let us look at the characteristics of cryptocurrencies which in most circumstances are common to all.

Transactional Characteristics:

- Irreversible:

A transaction, once confirmed CANNOT be reversed. No matter how much powerful a person or entity is, nobody can reverse any transaction after the confirmation, not even Satoshi. Money sent by you, intentionally or by mistake is simply sent. You cannot do anything else about it.

- Intangible:

No real-world entities are associated with any account. Cryptocurrency such as Bitcoins is transferred between addresses made from blockchains. You can analyse the flow of transactions but no user’s real-world entity is connected with their addresses.

- Instant and global:

Cryptocurrency enables instant transactions in the network and can be confirmed in the following few minutes. The network is global, so the transaction can be to someone sitting next to me or some relative who have moved to abroad.

- Secure:

As mentioned earlier, cryptocurrency uses cryptography process. Because of this process, the funds are locked using the public key. Private key owners can send cryptocurrency. Thus, it is impossible to break the schema due to strong cryptographic mechanisms.

- No permission required:

Cryptocurrency does not require any permissions from some authority. Users simply need to download a software which is generally free. There is no gatekeeper which means you are responsible for all the transactions that you make. Send and receive Bitcoins or any other cryptocurrency using the software only.

Monetary Characteristics:

- Supply Management:

The supply of tokens in any cryptocurrency is limited. The supply of Bitcoins will exhaust somewhere in 2140. An algorithm written in the cryptocurrency controls the supply of token. This implies that we can calculate the total monetary supply that will be available in future in the present day.

- No Debts:

There is no representation of debts in cryptocurrencies. All you see is the currency numbers as entries.

Considering both transactional and monetary characteristics, we can understand the impact revolutionary disruption caused by cryptocurrency. As there are no permissions involved in the cryptocurrency transactions, banks and governments hold no authority on the monetary transactions of the citizens. The transaction happens and then you just cannot do anything about it. The limited supply of token makes the monetary policy vulnerable, thus taking away the rights of central banks from manipulating the monetary supply.

While digital cash system failed to gain much attention from users, cryptocurrencies like Bitcoin became popular in no time because of its profound characteristics. You can consider cryptocurrency as digital gold which is kept away from any kind of political influence. It enables instant transfer of money across the globe without any hidden costs.

One Disruption Led To Another

The entire ecosystem of cryptocurrency is sudden invention. From its sudden invention to its outburst in different capital market areas, cryptocurrency has gained attention from global investors and speculators. If you think, you can only use this modern currency for payments, then you are wrong. Cryptocurrency market is hot and trending everyday with different new additions to it. There are exchanges that enable trading of the cryptocurrencies.

Initial Coin Offering

This is one of the hottest trends of cryptocurrency as it leads to creation of new cryptocurrencies. Initial Coin Offering means a person offers new currency to the investors in exchange of established cryptocurrencies. This implies that new cryptocurrencies are funded using the existing ones by selling the token on exchanges that have demand. Some of the cryptocurrencies that were funded by ICO are Ripple, Lisk and Ethereum.

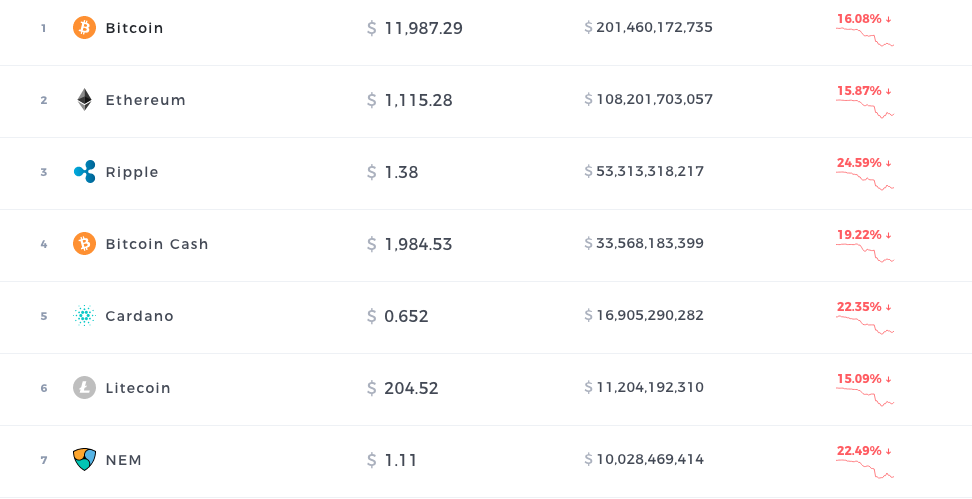

Top Trending Cryptocurrencies

When it comes to cryptocurrency, majority of the people have heard about Bitcoin. That being said, looking at Bitcoin’s current value, everyone cannot invest in this currency. There are several other cryptocurrencies that have good future scope and investors can definitely consider investing one of these.

How far will it go?

To be very honest, there is no correct answer to it. A lot of new cryptocurrencies come and go in the market. A few of them turn out to be promising while others fail in the first few months leaving investors with abandoned currency. However, people are still accepting it at a large scale because there will be no manipulation on the monetary front by any bank or government. Huge investments are being made on cryptocurrencies as people believe that this will change the world.

Fine way of describing, and nice article to obtain data regarding

my presentation subject matter, which i am going to deliver in institution of higher education.

Thanks for sharing your article. Nicely described, Informative Content.