India continues to be one of the fastest growing economies in the world, growing at about 7 per cent and is set to become the third-largest economy in the world by 2027. According to Deutsche Bank Research, there are between 30 million and 300 million middle-class people in India. With smartphones becoming omnipresent today, there is an increase in the demand for services and products that serve the needs of the ever-expanding middle-class working population in India.

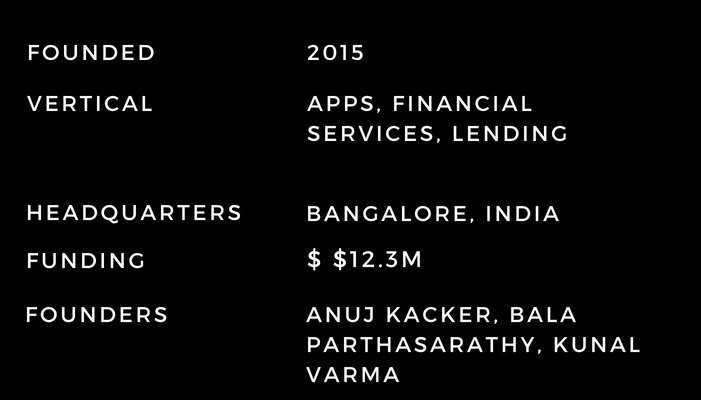

MoneyTap is one such company that recognised the opportunity in the challenges faced by the middle class working groups, that Is the need for small credit amounts. MoneyTap is India’s first personal credit line offering hassle and seamless lending experience to salaried employees in India via their app. We had an opportunity to interview Anuj Kacker, Co-founder, MoneyTap, who gave us a peek into their journey to success

1. What was the inspiration behind the inception of MoneyTap?

It was a combination of personal experiences as well as general observation. We observed the market need and realised that the middle-income group (the salaried class) has always been facing challenges with respect to credits, especially small amounts. People are not comfortable going to banks for loans for minimal amounts – this could be anywhere from Rs. 3000 to Rs.50,000 to 1 or 2 Lakhs. Asking for money from family and friends always has an embarrassment factor. The needs are what most of us have, that could be anything from medical, birth, death, school fees, deposit to take a rent on house, etc. In many cases, people even have fixed deposits that they just don’t want to break for a small need. This is where we thought of MoneyTap and wanted to be like a friend who could be reached out at fingertips.

Credit card penetration, the most popular product for offering credit that is not secured by a collateral, is shockingly low in India with just 24 million cards for a country of 1.2 billion! Personal Loans, another product offered by banks, has negligible uptake. Instead of trying to figure out how to sell more of the same credit cards or loans, I decided to find out what customers really wanted.

2. Could you brief us about how your business model works?

MoneyTap introduced the concept of a Personal Line of Credit/Credit Line for the first time in India when it launched in September 2016. The “Credit Line” means that the bank will issue a limit of up to INR 5 lakhs, without any collateral or charging any interest. Against this limit, using the MoneyTap app, consumers can borrow as little as Rs. 3000 or as much as Rs. 5 lakhs and repay it as EMIs from 2 months to 3 years. The interest is paid only on the amount borrowed and the rates can be as low as 1.25% per month. The limit also gets automatically topped up as soon as EMIs are paid back.

Any salaried employee can use this free Android app and in a few minutes, using a patent-pending Chatbot interface, provide all the information typically required by banks. The app securely connects with the banking systems to give them not only an instant approval but also a credit limit, depending on individual credit history. As an added convenience for shopping needs, a “MoneyTap RBL Credit Card” is also provided for the user. This is a regular MasterCard Credit Card that is accepted at all locations and for all card purchases – offline and online.

3. Which key strategy you keep in mind and share your success mantra?

MoneyTap is India’s first app-based credit line offered in partnership with banks and targeted at consumers. There is no other app in the same business and we are India’s only consumer-focused credit line on an app. In other words, MoneyTap not only qualifies you but stays in your pocket, to give you a bite-sized loan whenever you need it.

Middle-income customers making Rs. 25,000 per month or more, facing frequent cash crunch for regular needs like education, medical, birth/death, etc. are not serviced by financial institutions today without putting up collateral such as gold. Large needs, such as buying a vehicle, house, etc. are addressed by financial institutions, unlike online and off-line shopping. Though the latter often involves very high credit card interest rates of 40% if one doesn’t pay on time. This is the clear unaddressed need. When we spoke to customers, they not only wanted the above needs addressed but also wanted the product to be very flexible and convenient.

For the very first time, MoneyTap is bringing the access to credit with a single tap on the mobile phone. It is also introducing the concept of a credit line for consumers, in partnership with banks.

4. Which countries and regions are you currently focusing on? Which other regions do you plan to expand your brand presence?

We are currently focused in India. India’s first credit line is now available in 20 cities in India. We plan on expanding to 50 cities in India by March 2019.

5. “The industry brims with theories on what makes millennials tick.” How does this fact affect your business?

At MoneyTap, we are on a mission to make credit accessible to those who deserve it. The ubiquitous presence of smartphones and initiatives such as Aadhaar has made it possible for us to develop a truly powerful and disruptive financial instrument. The credit line for consumers with accessibility through an app is a new concept in India. We are excited about the opportunities it can bring to thousands of millions of Indians. For millennials, MoneyTap is like a friend who gives you money when in need. Be it marriage, birth, sudden death in a family, school fees, hospital bills or sudden cash crunch during the month end. We, at MoneyTap, want to make credit available for deserving and eligible candidates.

6. Share the biggest achievement of your company to date?

We’ve been lucky to have experienced so many achievements in such a short span. The size, of course, is subjective. For us, on-boarding a customer who is in dire need of money, and helping him out in time, is not just an achievement but also carries a great sense of gratification. Building a team of dedicated, highly intelligent and hardworking people is another. Our biggest achievement so far, apart from creating a completely new and much-needed category, that is a consumer credit line, is making 50 crores per month disbursements in just 18 months.

7. Where do you see your industry going in the next five years?

Fintech will see significant growth and innovation in the next few years. Innovations like IndiaStack and deregulation in the form of GSTN, payment bank licenses and demonetization along with a massive governmental push to move payments to digital will spur a significant growth in multiple areas of finance.

8. What makes you different from your competitors?

MoneyTap has created a new category – App-based credit line, addressing the middle-income customer’s basic needs. We fully expect both online players as well as large banks to jump in and address the need. Such an enormous need will have multiple players.

Pulling this off successfully requires a combination of User Interface Design, building scalable multi-tenancy systems, Data Science & Machine Learning, Consumer Credit & Risk Modeling, Deep Integration with banking systems, Digital Customer Acquisition expertise, Strong banking relationships at both the senior and mid-levels. In addition to a high-quality team and serious investors.

Neither a startup by itself nor a bank by itself will have all this expertise.

9. Two suggestions for the aspiring entrepreneur and upcoming startups?

India’s entrepreneurship is maturing fast. The best thing that happened was the bubble bursting – when that happens, a lot of the froth goes out of the market and the serious entrepreneurs can hunker down and build real businesses. There is no question in my mind about the underlying potential of our economy, the high quality of our entrepreneurs and our endless ability to innovate. But building strong businesses take time and in our environment, strong stomach. Both on the part of entrepreneurs and investors!

Entrepreneurship is not easy and not for everyone. But it’s addictive and some of the most creative moments in your life will be during this journey. And there is no other (legal) way to have a huge financial windfall besides running your own company