Unsurpassed Potential

Since the advent of the industrial revolution, people have always ‘’bought’ things. Even before mass production, it seems that the retail sector seemed to cater to people’s almost naturalistic urge to own things that they themselves could never make, or produce. This is not limited to daily necessities that one could have found in the neighbourhood marketplace – curios, artefacts, luxury items – you name it, and it has been on sale.

The technological paradigm dominating our century is changing the very face of how retail operates. Gone are the days of brick and mortar – or are they? The sector is so vast, that many simply fail to see the finer points of it. However, one thing is definitely set in stone: the unsurpassed potential of this market.

The retail sector, it seems, will never really diminish. Currently, it is one of the hottest markets with a standing revenue of over $24 trillion, slated to reach $28 trillion by 2019. The ecommerce market itself reached $1.89 trillion in 2016, and is also expected to top $4 trillion by 2020 – an unprecedented amount of growth, at any rate. Retail ecommerce sales—which include products and services (barring travel, restaurant and event ticket sales) ordered via the internet over any device—will reach $1.915 trillion in 2017, accounting for 8.7% of total retail spending worldwide. While the pace of growth for overall retail sales is subdued, the digital portion of sales continues to expand rapidly, with a 23.7% growth rate forecast for 2017.

When we are looking at the retail sector, we do not limit ourselves to brick and mortar retail anymore, because that would be highly reductive. It is in fact, one of the slowest moving indicators in the retail industry at large, despite its high revenue share.

When we talk about retail, this includes sales across all retail channels in its estimates for total retail sales. This includes sales from ecommerce retailers and transactions that occur over consumer-to-consumer (C2C) platforms such as eBay and other auction sites; and sales by motor vehicle and parts dealers and by gas stations.

Trends according to geographical analysis also paint a rosy picture for anyone interested in venturing into the retail sector:

Asia-Pacific is expected to remain the world’s largest retail ecommerce market throughout the forecast period, with sales topping $1 trillion in 2016 and expected to be more than double to $2.725 trillion by 2020. Expanding middle classes, greater mobile and internet penetration, growing competition of ecommerce players and improving logistics and infrastructure will all fuel ecommerce growth in the region.

The bulk of retail ecommerce will come from China, where sales reached $899.09 billion last year, <representing almost half (47.0%) of all such sales worldwide. While there is plenty of opportunity for growth, parts of Asia-Pacific are still faced with challenges. In Southeast Asia in particular, ecommerce still represents only a fraction of total retail sales. An underdeveloped digital payments infrastructure and a weak logistics framework have made these markets unprepared to handle high volumes of ecommerce orders and have kept ecommerce at a nascent stage.

That’s really it – the retail market is struggling to cope with technological progress, or at least the players are. This is mostly the case with emergent markets, as the US and China still remain at the top of their game. China, in particular, has really exploded with its growth and is still growing strong with the advent of their consumer-centric economic model shift.

Challenges

Supply chain innovation slowly declining

Building new facilities isn’t cheap, but relying on outdated, cookie-cutter facilities is likely to weaken market agility.

Incorporating specialized facilities such as mega e-fulfillment centers, presortation facilities, local delivery centers and returns processing centers can drive the logistical imperative to fulfill online orders efficiently and conveniently.

Obsolete Transportation Infrastructure

This is actually more favourable for e-retail, since its growth is quickly seeing the replacement of a lot of obsolete transportation infrastructure. This discourages undeveloped retail outlets, making internet sales leapfrog over physical retail growth. This also leads to the outsourcing of logistics, which is frankly a better option than managing your own network without prior expertise.

Reluctant linking to LBS

Till date, logistics clusters and on-ground presence was key for many retailers. With the advent of ecommerce, a lot can be saved in terms of making logistics more efficient and saving on the expenditure in terms of land, manpower, maintenance and other such resources that come with brick and mortar. LBS, or location based services can not only help make logistics more efficient in terms of route mapping and on-site analysis, but can also provide hard demographic data over a period of time which will indicate what works in which area.

However, the reluctant adoption of the same has proved to be harmful for those who want a larger presence.

Non-uniform, unplanned expansion

Many stores, when doing fluidly in the hyperlocal model, make unwitting steps towards expansion, since it is lucrative. However, this may be drastic if you do not know your market, and if you do not scale up properly – with the help of technology, if you ideally want to avoid costs. Also, investigating local customs to meet preferred forms of convenience can drive success locally as well as innovation globally. For example, the U.K.’s recent trend of “click and collect’ in brick-and-mortar locations is an idea that’s gaining momentum globally; Australia’s purpose-built parcel lockers are catching on; and India’s pay-upon-delivery option is also a convenient solution in some locales.

Cybercrime

As is unavoidable with the rise of transactions increasingly happening online and virtual currency slowly gains merit, cybercrime has also shot up. Many consumers do not engage due to a rightly warranted fear of getting hacked, their bank accounts and personal information compromised.

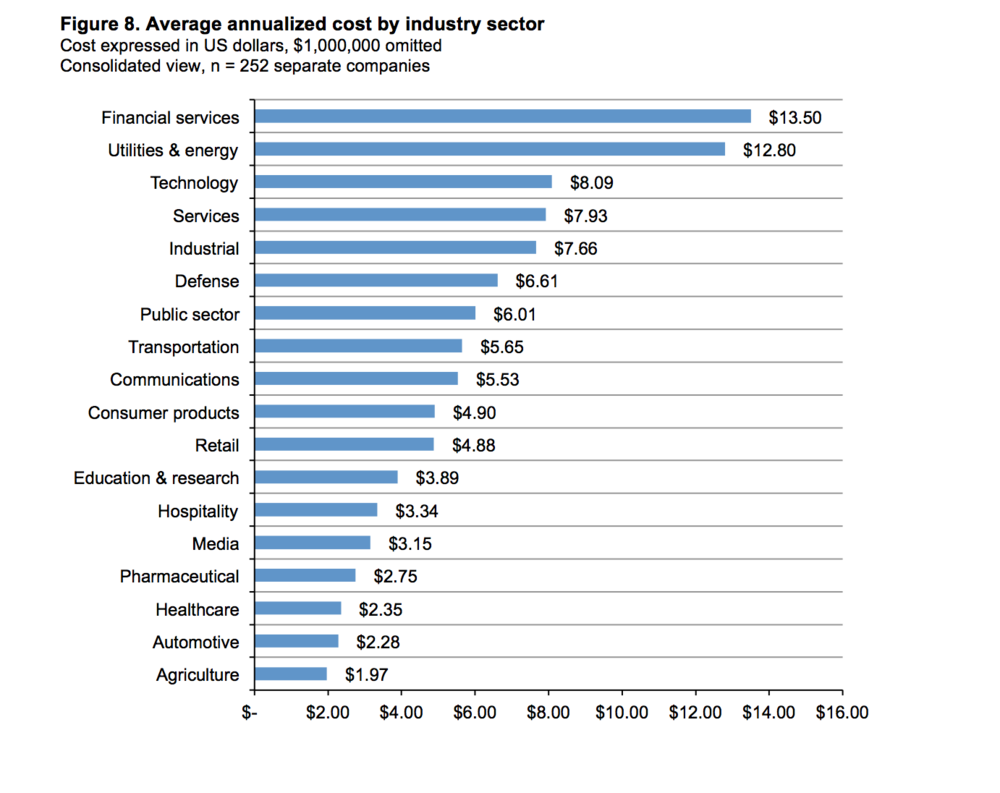

The image below, taken from the Ponemon Institute and Hewlett Packard’s 2015 Cost of Cybercrime Study, shows how retail is hovering around the middle in terms of average costs of a cybercrime breach, coming in at $4.88 million. Still, losing almost $5 million for the average breach is not exactly something to celebrate.

Other Security Oriented Concerns

Merchants also risk fraudulent purchases if customers are using stolen credit cards or fraudulent repudiation of the online purchase.

Secure Sockets Layer (SSL) encryption has generally solved the problem of credit card numbers being intercepted in transit between the consumer and the merchant.

However, one must still trust the merchant (and employees) not to use the credit card information subsequently for their own purchases, and not to pass the information to others.

Hackers might break into a merchant’s web site and steal names, addresses and credit card numbers, although the Payment Card Industry Data Security Standard is intended to minimize the impact of such breaches.

Identity theft is still a concern for consumers.

Customer Acquisition and Retention

This isn’t a new problem for a retail business, far from it, but the solutions to this problem have changed dramatically and continue to do so.

20 or 30 years ago, gaining customers was much simpler; if you had the budget you simply opened the biggest, most prominent stores and bought the best advertising space. If your products were good or desirable enough, you’d probably get the customers. This approach still exists online: it’s called paid search and it unquestionably works.

However, with online retail marketplaces, the chicken and the egg problem also arises. If not that, then there definitely comes the issue of differentiation – it is noted that pricing is one of the most valued indicators when it comes to choosing a brand, or marketplace. In such an inundated market, it will be hard to differentiate. Retention is another challenge altogether, with you needing to keep your strategies dynamic – without big data, analytics and customer outreach, you are as good as dead.

The shift to mobile, online message services for marketing

Technological adoption, in the right manner is what is sorely lacking in many retailers today. Those who are established spend a lot of money using tech ineffectively, and others do not have enough capital for the long haul. Engaging in intrusive advertising will be a definitive problem, but at the same time, geo-marketing is something you want to look out for. Similarly, using chatbots and other technological options cleverly will indicate the survival for retailers in the future.

Trends for the future

Analytics yield more actionable marketing intelligence

In 2015, retail digital marketing was focused on CRM analytics to drive segmentation learning of consumer behaviour, offering decisions and promotional value to enable personalization across business channels. The digital marketing team’s skill set has grown from this experience, expanding into what were formerly considered IT functions including data driven analysis. However, the team will still look to IT for enabling technology to optimize and enhance the outcomes.

Analytics platforms can be made readily available in minutes instead of hours, days or even weeks in some cases. Retailers who embrace this new model will be the most likely to capture the interest of data analytics and engineering professionals and graduates required to transform the business into data driven powerhouse capable of value-based decisions and automation.

Destroying the time crunch

The top source of friction most customers are feeling today is the effect of time crunch. We are busier than ever and want things faster and easier with less commitment. We want personalized experiences that account for our preferences and constraints. Retailers must track these trends and find ways to create remarkable customer experiences that save our customers their precious time. This is most easily done with the help of the mobile first approach, with a marvellous UI/UX experience integrated in the app that will serve as the SPOC for all your purchases. Consumers love the streamlined experience tech can grant them – but this will fall flat in retail if logistics is not optimized, or specialized with outside help.

This means investments in the planning and designing for mobile form factors to create a unique brand experience purpose-built for mobile, as opposed to websites optimized for viewing on a mobile device. The main goal of the mobile first approach is to deliver convenience, product/service visibility and a seamless experience to the consumer, including relevant third party integration, social integration and most importantly personalization.

Hybridised Retail Models will Succeed

Fuelled by secure networks, cloud enablement, agile development, social engagement and mobile empowerment, many retailers will be looking to merge their business and digital strategies with a platform strategy to build an ecosystem of value for their brand through real-time engagement with buyers, sellers and a multitude of third party players.

This has yielded many benefits and established a core capability to drive a digital strategy and consumer adoption. Still, this approach results in the need to take different approaches to audience targeting based on the consumer end-point and technology delivery channel, resulting in isolated experiences and more effort.

In 2016, efforts will focus on merging these experiences into a single digital channel where the consumer will experience the brand instead of a brand within a channel. This will help retailers reach critical mass through digital to achieve cross-channel integration, coming many steps closer to meeting the promise of ‘omni-channel’ engagement.

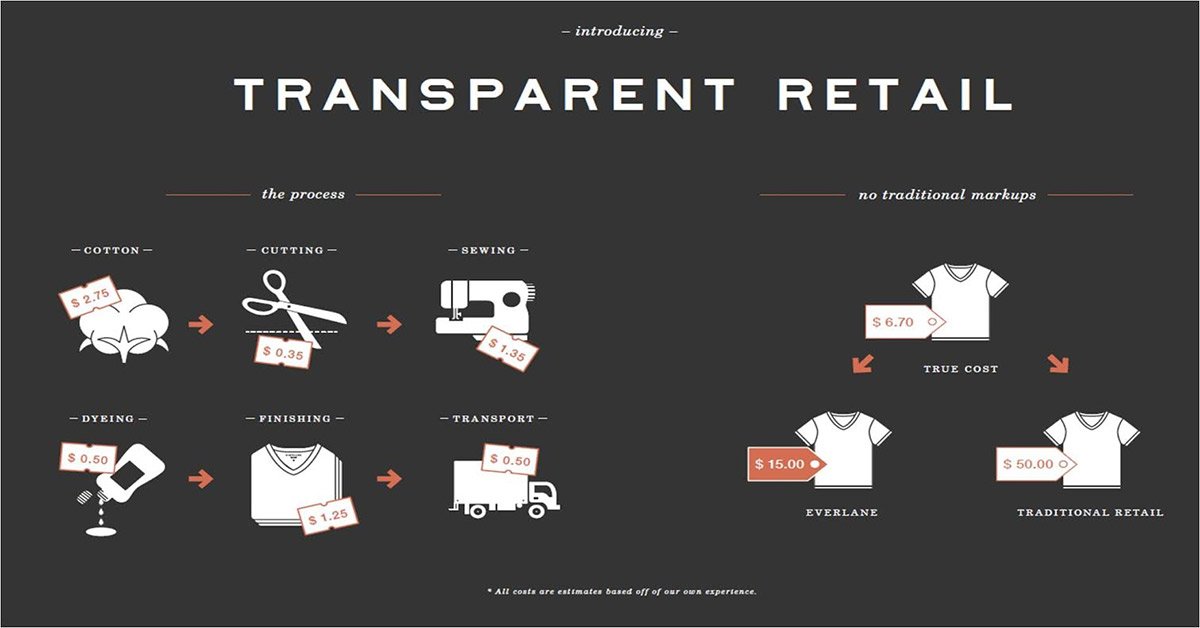

Transparency Redefined – A consumer centric-world

In 2016, the major drivers are transforming the supply chain into a cohesive consumer driven model focusing on flexibility, visibility and choice of fulfilment options regardless of touch point. In essence, the consumer becomes a brand unto themselves, combining their distinctive preferences to form a personal relationship between their brand and that of the retailer. This requires a new level of engagement with the consumer to create value for them not only within the commerce transaction but also within the supply chain.

The benefits to the consumer are obvious. They are able to see what, where, how and why the product/service is obtained and delivered and able to establish preferences for each step in the process. The value to the retailer is in the segmentation by consumer to improve brand loyalty through optimized assortment, direct marketing and stock availability while engaging in a flexible fulfilment model that reduces their costs of delivery, overstock and waste.

The Internet of Things (IoT)

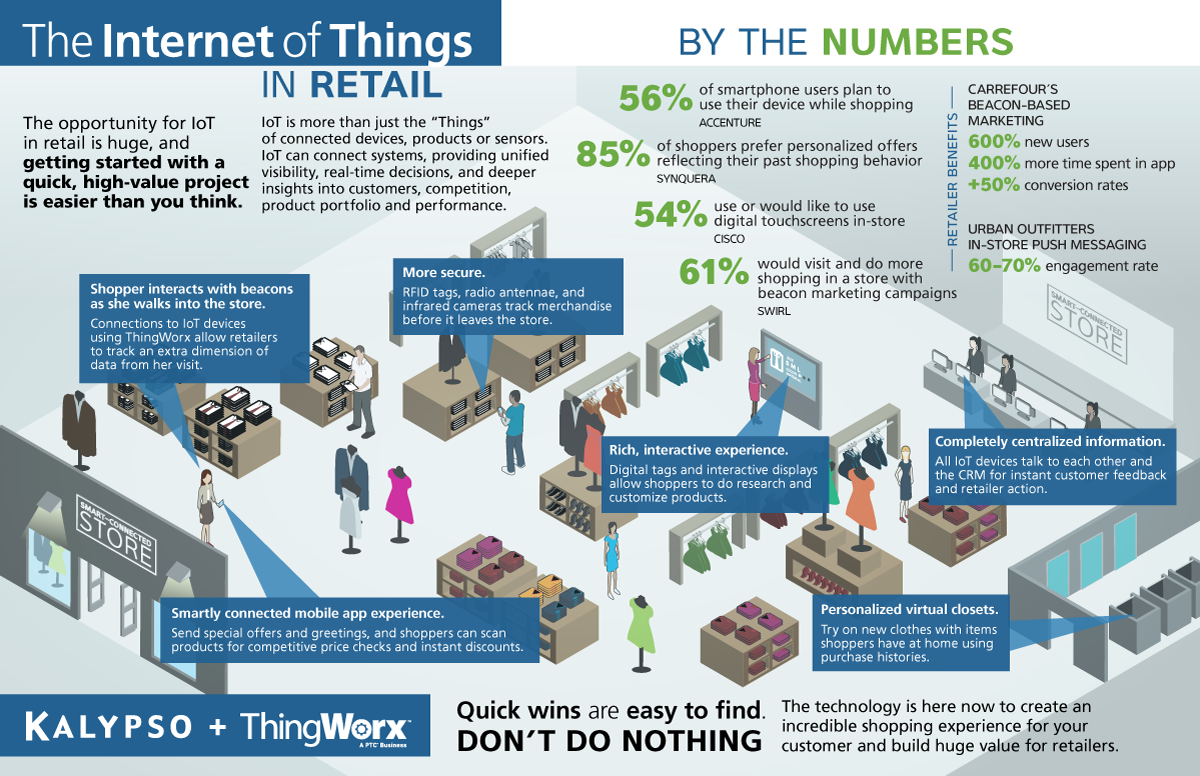

In 2016, the rapid inclusion of IoT capabilities in consumer technologies such as kitchen appliances, automobiles, lighting, home security and home media devices will push retailers and influence consumer behaviours and expectations by overcoming present barriers and questions surrounding IoT technologies. The consumerisation of IoT will drive new demands for connected devices in retail that will engage the consumer in new and more intimate ways. This, in turn, will drive greater volumes of data which will improve the precision and value of analytical decision making.

Retailers will be able to use IoT to more accurately collect, analyse and measure success but most importantly automate many functions that will allow the business to focus on planning, marketing and targeting consumers with richer experiences and disruptive loyalty models. Some key IoT technologies in play today for retail to consider are wearables, connected automobiles, augmented reality and beacons. In the end, the goal is connected everything but most important is using IoT to connect the brand with the consumer.

Conclusion

As can be anticipated, it is a very exciting moment for the retail sector, which is surely slated to face tremendous disruption with every new technological innovation.

We consider it our duty to inform potential clients of the perils, and advantages to be found in every sector. We also consider it our privilege to work with those who are interested in augmenting their ideas with powerful technology. We are eager and only too happy to walk you through the possibilities of these measures, targeting key concerns in the sector itself, so that your business can bloom with minimal hitches.

All the technological solutions mentioned above – in the realm of big data, analytics, mobile app development, the engineering of virtual architecture and so on – can be found by working with us, in the most cogent manner possible. We will be honoured to help your venture disrupt the world of etail – all you need to do is take the first step, and open a dialogue with us.