We are no strangers to the intrusion of Location Based Services in our lives. Since the advent of Google Maps, nothing has been quite the same for all technological platforms and their functionality – that little icon of a pin is now so ubiquitous, the millennial generation cannot even dream of functioning without access to a mapping service that is either exclusive, or integrated with other apps.

Where you are matters – and painstakingly so, for many companies spanning several industries – be it clothing, or restaurants, or healthcare, or even the social media matrix that shares every movement of yours, provided you give it the right set of permissions.

The use of location based services is now integral for anybody who wishes to have the edge over their competitors, because it taps into a well of marketing opportunities and relevant branding. The quality and accuracy of these services for other businesses like those in the logistics and delivery-based services determines their success or failure – often overnight. Yet other on-demand services in the new industry are all heavily location centric – so rest assured, this market is here to stay.

A Burgeoning Industry

Well, imagine you’re walking down the street with your smartphone, trying to locate a friend’s house. When you’re in the vicinity of this coffee shop, your phone pings with a message – If you show it at this coffee shop, certain items on the menu will be half price! You unduly make a turn to the shop, allowing them to make a sale they possibly couldn’t have.

Thus, the demand was created almost instantaneously, with the coffee shop even managing to hook a wayward customer apart from its regulars. For half-price on a few items, the buyer may even go for more, and the shop can actually clear certain items off of its menu. You can also create a loyal customer, if your service is actually that good, and stands apart from your competition – i.e. other coffee shops.

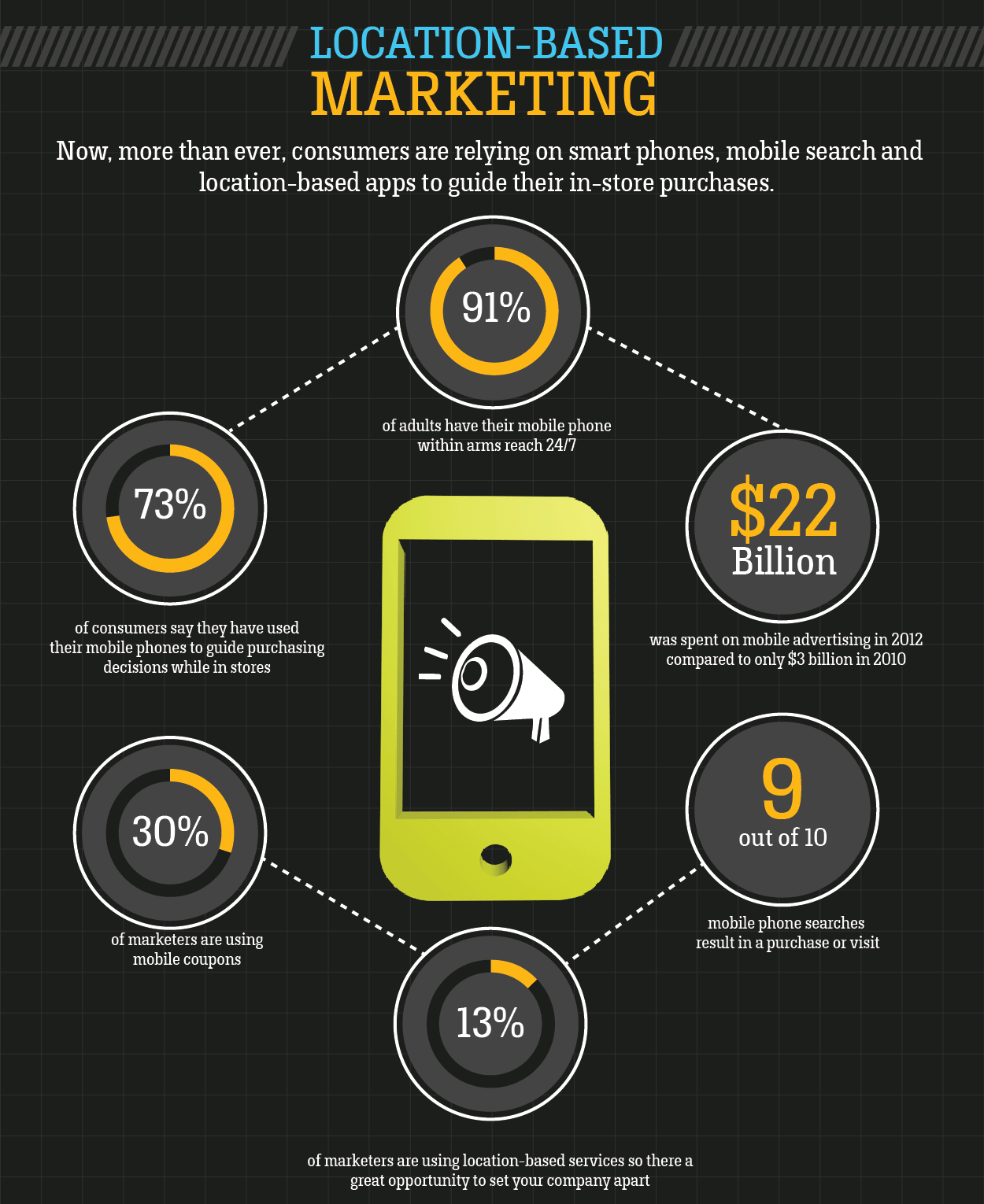

This type of branding, with promos and other such offers that trigger remotely and instantaneously, are what the LBS industry hinges on when tapping into the mobile market. Smartphone penetration is such, that this sort of branding is actually very lucrative.

The overall market is expected to grow from USD 15.04 Billion in 2016 to USD 77.84 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 38.9%.

The LBS industry also involves a vast gamut of services –

Navigation + Mapping & GIS:

Route planning and turn-by-turn instructions based on GNSS positioning support both pedestrian and road navigation. Sensor fusion is enabling the uptake of indoor navigation.

Mapping & GIS:

Smartphones enable users to become map creators

Geo marketing and advertising:

Consumer preferences are combined with positioning data to provide personalised offers to potential customers and create market opportunities for retailers.

Safety and emergency:

GNSS, in combination with network based methods, can provide accurate emergency caller location.

Enterprise applications:

Mobile workforce management and tracking solutions are implemented by companies to improve productivity.

Sports:

GNSS enables monitoring of users’ performance through a variety of fitness applications, such as step counters and personal trainers.

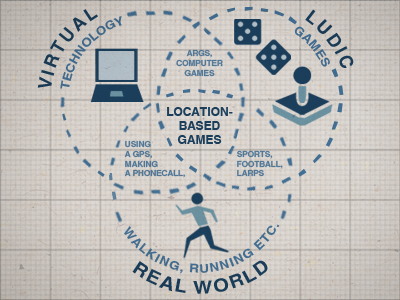

Games and augmented reality:

Positioning and virtual information are combined for user entertainment and Gamification purposes for learning.

Social networking:

Friend locators provided by dedicated apps or embedded in social networks use GNSS to help keep in touch and share travel information.

This is all the more enhanced with the Internet of Things (IoT) mesh, where multiple devices can incorporate geo-sensors and location based tech for augmenting its service – digital cameras, fitness gear or even a ring, for that matter.

Almost 3 billion mobile applications currently in use rely on positioning information, with app downloads posited to steadily increase: from $2.8 billion in 2014 and will hit $7.5 billion by 2019.

Yet another report by Juniper Research stated that Mobile Context and Location Services market will reach $43.3 billion in revenue by 2019, rising from an estimated $12.2 billion in 2014. The report highlighted that over two-thirds of revenues will be driven through highly targeted and contextually aware ad-supported apps by the end of the forecast period. In addition, the Pew Research Centre determined that 90% of smartphone owners use them to get information related to their location.

Challenges

The LBS industry mostly faces problems of adoption, because of it’s a new entrant on the block. Stagnation and lack of innovation are hardly concerns for this, because market driving forces are very powerfully supportive of its growth. The challenges exist nonetheless, so we have a few glaring ones in our discussion.

Reluctance and the Black Box

Since the LBS industry is new, many extant businesses and sometimes even new ones are hesitant before using them – either due to a lack of awareness and information regarding its troubleshooting; in fact, a Forrester Research’s report “Make Smart Wireless Location Technology Decisions” found that just 3% of businesses surveyed were actually using beacons, while another 11% were piloting them.

In addition, when it comes to the maintenance of said devices – for people who don’t utilise them efficiently, they can be quite power and resource intensive, an investment most people will not want to make unless they realise the power of LBS oriented marketing. Bluetooth beacons or Wifi oriented meshes? Many store owners do not know what the answer is. Some tech can be expensive, while other tech may just be necessary for stores with larger areas – there are many variables to crunch. This extends to all aspects of extant businesses – be it stores or logistics chain.

Privacy

Privacy is a big concern. Most services are finding it hard to draw the line between intrusive and just good marketing, and LBS can be considered seriously intrusive by many users. In addition, given the rapidly developing market and the plethora of service providers in the industry, it may be hard to distinguish between those who are truly secure and those who are not – cloud based services along with solid analytical software needs to be implemented for secure, safe and seamless access to data.

Information privacy, communication privacy and many other modes need to be solidified for users to begin trusting LBS based industries. In order to be able to effectively use various LBS applications such as the friend finder application, location-based games, location-based coupons, location-based deals, and location-based advertisements, LBS users have to reveal their location to the respective network providers, advertisers, and other third parties.

This basic gap as concerns trusting service providers can be quite problematic, and makes them reluctant when it comes to adoption again. There are no accurate gauges of how secure services really are, with the LBS market using a lot of extraneous and shared information networks for its services.

Lack of standards

Again, as with any industry worth its salt and exponential growth – it is only natural for standards to be somewhat blurry. Consumers do not have many gauges to filter good services from the bad – for providers, the key here will be differentiation, where your product needs to necessarily stand apart from your competition. Avant-garde technology also comes with a similar learning curve and the will to adapt, which you will have to look out for when venturing into this market.

Lack of universal API

This concerns local app development. One needs to examine prominent application servers to provide this capability to avoid unique and proprietary APIs from start-ups. This can also provide companies with a competitive advantage, but since the market is inundated with different services and differing datasets, Google Maps is often the go-to, and costly option. Other geo-tagging and referencing services for alternatives can be considered, but there is hardly any incentive for them to provide exemplar services – in addition, public datasets and map-based archives are not being proactively pursued, in order to be relied on.

Regulation and Laws

With no clear authority or ruling over LBS oriented capabilities, and stricter protocols may come into effect regarding the dissemination of personal and social user data – marketing using different approaches, or technology that relies on other indicators needs to be worked out and implemented – engineered, in the very least to anticipate for a loss in marketing potential as a result.

Privacy measures will also have to be improved as a result, so half-hearted attempts at technology will simply not work – evolution will be key in order to profitably ride the rise of the LBS industry.

Cost of Wireless Data Services/ Technology

Many specialised high-grade wireless services come with high-grade costs. There need to be some commercialised packages for greater adoption of these services, especially with local small-time vendors and other users who would prefer not to utilise these services given their high data hunger on both, data services and in terms technological requirements like reliable sensing technology.

Costs dealing with technology have to do with a lack of industry standards and associated costs. Localization capabilities of handsets, processing power, quality of co-ordinate data streamed to the LBS devices and so on are all determined by how much one pays, and costing needs to be more lucrative for entrants.

The World of LBS

Here, we decided to utilise a different approach. The LBS industry sits at the crossroads of commerce, society and technology, with equal opportunities in all these sectors and their respective industries. Hence, we tabulate the trending use of LBS along with possibilities – which in turn, we could engineer for your business or idea.

The major areas of opportunities for these systems include-

Navigation, local search, enterprise services, mobile advertisements via LBS.

Location-specific health information

Tourism

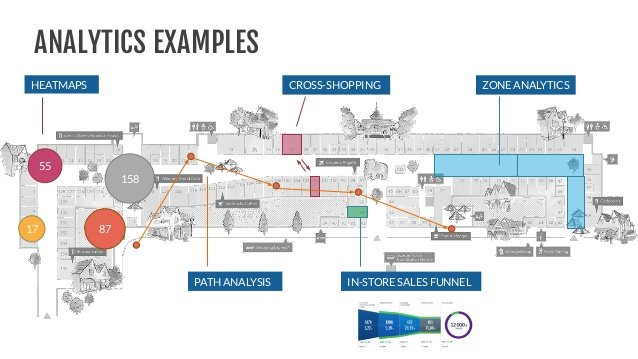

Consumer tracking and Location-based Business Intelligence (BI).

The industry is also divided into eight service categories based on primary function according to be Berg Analytics:

Mapping and navigation

Local search and information

Social networking and entertainment

Recreation and fitness

Family and people locator services

Mobile resource management

Mobile advertising

Enterprise and B2B services.

Certain Trends

The social networking and entertainment category is now the largest LBS segment in terms of number of users and revenues. It comprises a broad set of services that can be segmented into general social networking, chat and messaging apps, friend-finders and location-enhanced games.

The mobile channel has become a priority for the leading social networks that see rapid growth in access from mobile devices. Many of these services have various forms of location support ranging from sharing geo-tagged content to location sharing and check-in features. Mapping and navigation is the second largest segment in terms of revenues and the third largest in terms of number of active users.

The number of active users of mapping and navigation services is still growing. Revenues in general are posing a problem due to the lack of clear-cut, well defined revenue models in the LBS field – most of them employ tertiary methods and advertisements to make added money, while their technology itself might be generic in its approach.

This is only increasing slowly as competition from free and low cost services has intensified. More navigation service providers are now focusing on freemium apps where the core navigation service is free and users have the option to purchase additional content and features.

Local search and information services is now the second largest LBS category in terms of unique users, driven by the adoption of handsets with improved capabilities and changing user habits.

The recreation and fitness segment is also growing in terms of active users and revenues along with current trends of increasing attention to personal wellness. Recreation and fitness apps that turn smartphones into convenient substitutes for GPS devices and sports watches can cater to the needs of many outdoor and sports enthusiasts.

Broader availability and declining costs of smartphones is also enabling increasing adoption of workforce management services that aim to improve operational efficiency for businesses.

Many businesses are now adopting more standardised workforce management apps, even large companies that have previously used customised solutions, in order to reduce cost of IT system procurement and maintenance. Mobile advertising and enabling various forms of enterprise and B2B services still remains a focus area for many mobile network operators.

Besides working directly with major customers, operators are also exploring opportunities to leverage their assets, for instance by opening their location platforms to third party developers and location aggregators that play an important role as intermediaries between mobile operators and developers.

Mobile operators can provide network-based location data for a wide range of services such as fraud management, secure authentication and location-based advertising. Some mobile operators have now started to use anonymous bulk location data to improve the performance of their networks or to support internal marketing campaigns, for instance to upsell mobile broadband services, as well as support external customers in the mobile advertising industry.

Location analytics data is also being adopted for diverse purposes such as site selection in the retail industry, as well as for

urban planning and traffic monitoring.

In Conclusion

As can be anticipated, it is a very exciting moment for the location services industry. The sector will surely face tremendous disruption with every new technological innovation.

We consider it our duty to inform potential clients of the perils, and advantages to be found in every sector. We also consider it our privilege to work with those who are interested in augmenting their ideas with powerful technology. We are eager and only too happy to walk you through the possibilities of these measures, targeting key concerns in the sector itself, so that your business can bloom with minimal hitches.

All the technological solutions mentioned above – in the realm of big data, analytics, mobile app development, the engineering of virtual architecture and so on – can be found by working with us, in the most cogent manner possible. We will be honoured to help your venture disrupt the LBS vertical – all you need to do is take the first step, and open a dialogue with us.